Global 2020 air-conditioning market: figures and trends

Beyond the sharp decline in the air conditioning market in 2020 linked to the health crisis, strong trends have emerged: development of health-related functionalities, search for better energy efficiency and increasing use of R32.

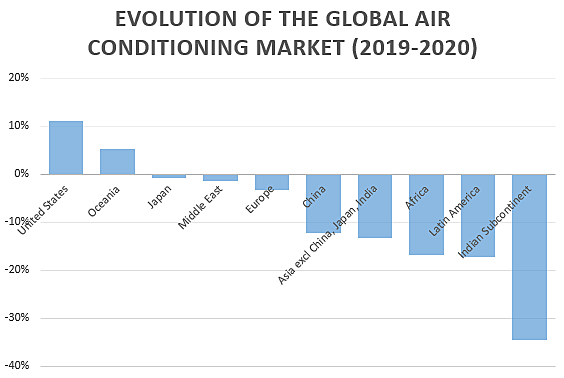

According to JARN (1), the global air conditioning market in 2020 declined by 8.9% with sales dropping to 119 million units (including room and packaged air conditioners). Despite very favourable weather conditions for air conditioners sales, this market fell sharply, mainly due to the Covid-19 pandemic which spread from the beginning of 2020.

While the impact of the health crisis on sales of air conditioners has been very negative in regions such as the Indian subcontinent and Latin America, markets such as the United States and Oceania have nevertheless recorded positive results, as shown in the diagram below:

Despite a sharp decline, the Chinese market nevertheless represents just over 40% of the world market.

The pandemic has impacted the air conditioning market and has also influenced demand trends. Demand for ventilation and air purification functions has increased. Many manufacturers such as Panasonic (2), Daikin and Sharp have released new technologies to kill or inhibit viruses. It is expected that by 2021, air purification technologies for virus inhibition in large areas will also be developed.

Another noticeable trend on the part of manufacturers is the increasing availability of energy-efficient units. This is partly the consequence of the introduction or strengthening of standards for minimum energy efficiency of air conditioners, for example in China, Thailand or Malaysia. Thus, in China, following the official publication in January 2020 of the new "GB21455-2019" standard applicable to unit air conditioners, the energy efficiency of this equipment is expected to increase by 14% in 2020 and 30% in 2022.

In order to increase in the energy efficiency of room air conditioners, since 2018, followed by South Korean and Chinese manufacturers, Japanese manufacturers have focused on promoting entry-level inverter air conditioners, leading to their rapid penetration in Southeast Asia and India.

Regarding the refrigerants used, the replacement of R410A by R32 - which has a GWP three times lower - is intensifying in Europe, Japan, Southeast Asia, India and Australia. In EU countries, room and packaged air conditioners operating with R32 accounted respectively for 40% and 80% of the market on average in 2020. In China, a draft list of recommended alternatives to HCFCs issued by the Ministry of Ecology and Environment specifies propane (R290) for room air conditioners and R32 for packaged air conditioners.

Sources:

- JARN, Special issue, January 25, 2021

- https://iifiir.org/en/news/nanoe-x-technology-could-inhibit-covid19-in-air-conditioners