Insight into the recent decline in heat pump sales in Europe

The EHPA reports that heat pump sales in 14 European countries fell by around 5% overall in 2023 compared to 2022.

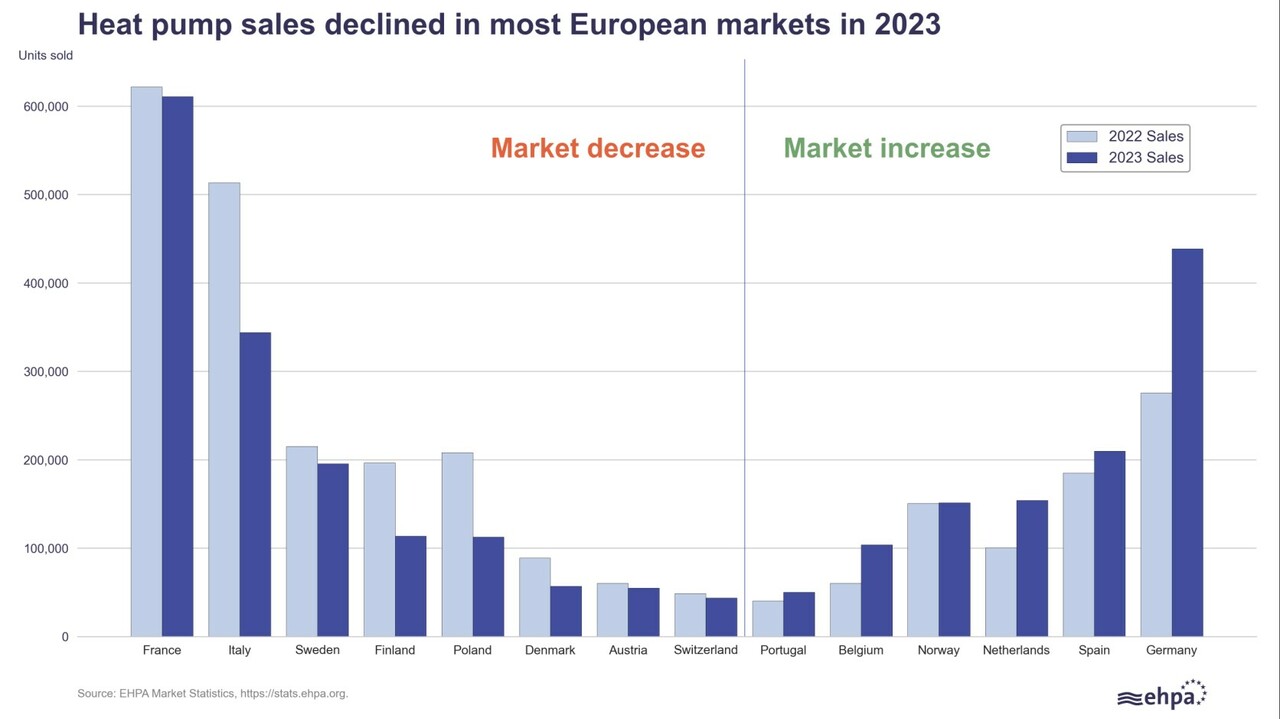

After record sales in 2021 and 2022, the European Heat Pump Association (EHPA) reports that sales declined significantly in several European countries in 2023, especially in the second half of the year. Overall, heat pump sales in 14 European countries fell by around 5% in 2023 compared to 2022, from 2.77 million to 2.64 million. [1]

Some countries still experienced a market increase in 2023, although not enough to offset the overall decrease. (see figure below)

According to the German heat pump association (Bundesverband Wärmepumpe - BWP), sales rose by 59% in Germany in the first half of 2023. Unfortunately, a controversial and intensive public debate concerning a heating law led to the general ban on new fossil-fuel heating systems being postponed by several years from the originally planned date of 2024. Uncertainties also arose about the new financing framework for heat pumps, which brought the market to a standstill in the last quarter of 2023. [2, 3]

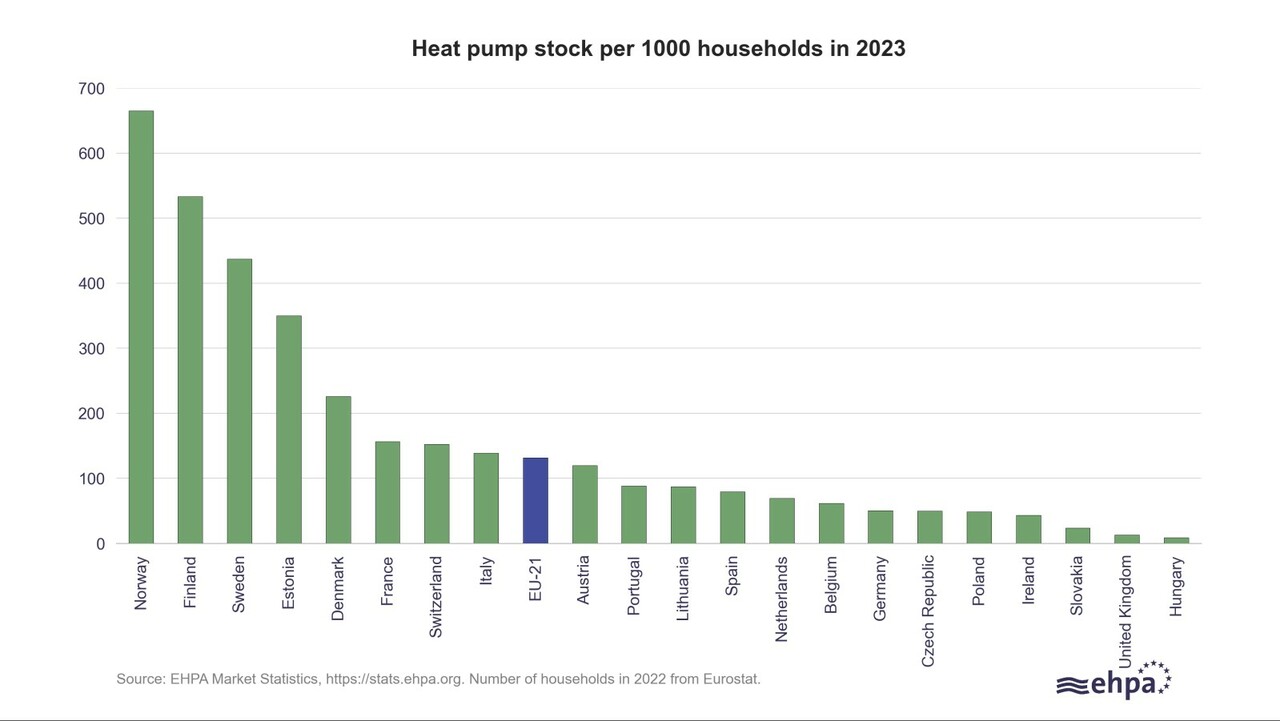

In France, Italy, Sweden, Finland, Poland, Denmark, Austria and Switzerland, heat pump sales dropped last year. This list includes three Nordic countries, with sales in Finland down by 37%, Denmark down by 25% and Sweden down by 5%. It is worth noting that heat pumps have become the main source of heating in many Nordic households, especially in Norway (see figure below).

However, even in Norway, a study has shown that the heat pump market can be affected by challenges [4] such as:

- policy changes

- shortage of specialised training programmes for professionals on air-source and ground-source heat pumps (the latter being more efficient in cold weather but more expensive to install)

- lack of public awareness campaigns.

According to a market analyst from the Norwegian heat pump association (NOVAP), the current decline can be related to high housing interest rates, a drop in residential construction and a slight decrease in moving activity. [5]

Overall, the slowdown in heat pump sales is affecting the EU’s climate and energy targets. EHPA points out that stable policies and a guarantee that electricity is no more than twice the price of gas – for example through a carbon price and tax breaks – are crucial to make electric heat pumps a financially worthwhile investment. [1]

Sources

[1] https://www.ehpa.org/news-and-resources/news/heat-pump-sales-fall-by-5-while-eu-delays-action/

[2] https://www.cleanenergywire.org/news/heat-pump-sales-reach-record-2023-controversial-law-causes-uncertainty

[3] https://www.pv-magazine.com/2024/01/25/germany-hits-356000-heat-pump-installations-in-2023/

[4] Sadeghi, H., Ijaz, A., & Singh, R. M. (2022). Current status of heat pumps in Norway and analysis of their performance and payback time. Sustainable energy technologies and assessments, 54, 102829. https://doi.org/10.1016/j.seta.2022.102829