Natural refrigerants drove the global commercial refrigeration market in 2023

According to JARN, natural refrigerants in commercial equipment are gaining popularity, namely driving the demand for equipment renewal in Europe.

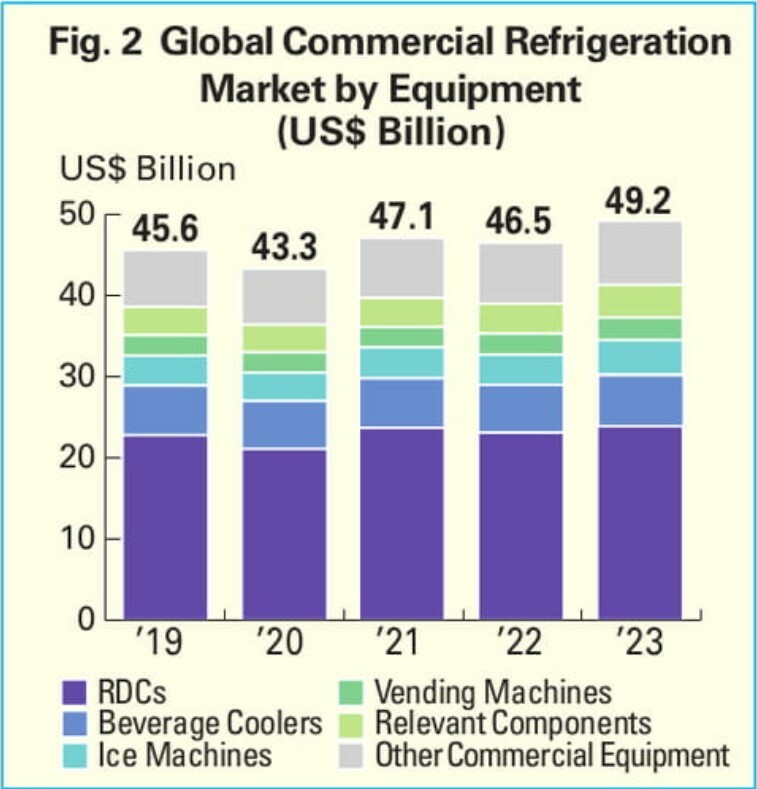

In its September special issue, JARN estimated that the commercial refrigeration equipment market amounted to $ 49.2 billion in 2023, up 5.8% from 2022. Of this total, the refrigerated display cabinet market represented $ 23.9 billion, commercial equipment such as refrigerators, freezers and condensing units $ 7.9 billion, beverage coolers $ 6.4 billion, ice machines $ 4.2 billion, relevant components $ 4.0 billion and vending machines $ 2.8 billion.

The impact of natural refrigerants on refrigerated display case (RDC) and condensing unit (CDU) markets

Supermarkets and convenience stores represent the main applications for RDCs. Since 2022, investment in large scale supermarket projects has significantly declined in some of the largest markets, such as Europe, Japan and China. This has resulted in more restrained demand for commercial refrigeration equipment. For instance, in the US, the market growth rate has declined due to inflation, supply chain issues, changes in consumer behaviour and competition. In Japan, shipments of RDCs decreased by 1.3% during the 2023 fiscal year compared with 2022 (figures from the Japan Refrigeration and Air Conditioning Industry Association – JRAIA – fiscal year end in March).

Nevertheless, in Europe, the widespread adoption of natural refrigerants has led to a demand for equipment renewal. Despite an overall shrinking market, refrigerating equipment with natural refrigerants such as CO2 (R744) is enjoying double-digit growth in the European market.

The global R744 CDU market experienced a high double-digit growth, driven by increased demand for frozen food and renovation of existing warehouses. Small R744 refrigerating systems are also gaining in popularity in Europe, Latin America and the US. It is reported that even in the absence of government subsidies, many convenience stores select R744 CDUs for their low running costs.

In India and Southeast Asia, the market potential is estimated to have increased by 14.3% in 2023 with India actively promoting natural refrigerants and energy-saving equipment.

Source

*JARN Special Issue, September 25, 2024