LNG remains the main driver of global gas demand in 2021-2025

In a recent report, the International Energy Agency (IEA) analyses the massive decline in gas demand in 2020. The covid-19 crisis has affected gas consumption mostly due to lower electricity demand in the industrial sector. IEA expects global natural gas demand to recover in 2021-2025, probably led by China and India. Liquefied natural gas (LNG) is expected to remain the main driver behind global gas trade growth.

Impact of covid-19 on gas consumption and LNG imports

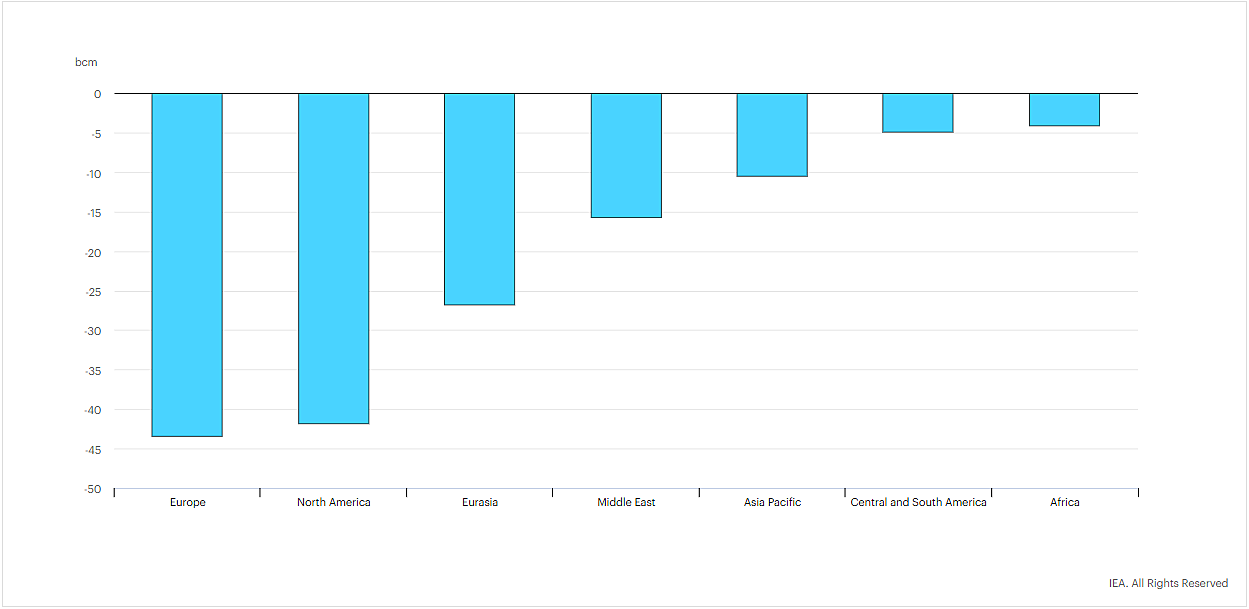

According to the IEA Gas 2020 report, global natural gas market is expected to drop by 4% in 2020. This represents a 150 billion cubic metres (bcm) drop, occurring in the aftermath of the coronavirus pandemic.

In Europe, the implementation of nationwide lockdown in several countries resulted in a sharp drop in natural gas consumption, falling by 11% (a drop of 10 bcm) between the start of lockdown in mid-March and end of May. This decrease was mainly caused by reduced demand from the industrial and power generation sectors. Indeed, demand for natural gas in the industrial sector declined by 15% year-on-year between mid-March and mid-May in countries with strict lockdown measures (Belgium, France, Italy, Spain and the United Kingdom). Despite its plummeting gas demand, European LNG imports increased by above 20% year-on-year over the first five months of 2020, thanks to its ample regasification capacity and flexible pipeline supply sources.

In the United States, demand for natural gas from the industrial sector declined by 3.6% year-on-year between mid-March and mid-May. However, in the power generation sector, the demand for natural gas increased by 3.4% over the same period. LNG imports halved over the first five months of the year compared with the same period in 2019.

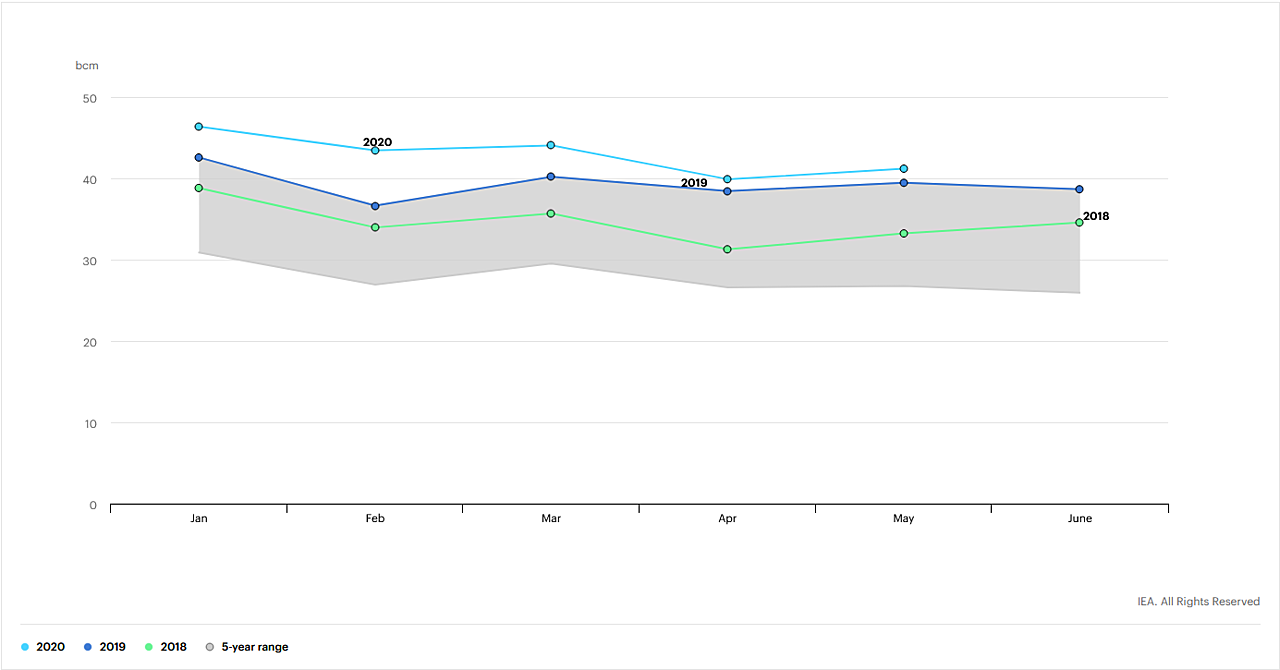

However, lower demand did not appear to affect LNG supply in the initial months of 2020. US domestic gas production and global LNG supply increased compared to 2019. LNG exports almost doubled. The United States became the largest source of LNG supply to Europe, overtaking Qatar and Russia, and accounting for over 25% of Europe’s LNG imports.

Japan, the world’s largest LNG importer, saw its imports decrease by close to 5% year-on-year over the first five months of 2020. LNG imports were affected by warmer than usual weather, slower economic activity and the decreasing share of natural gas in the country’s electricity mix.

LNG imports into other Asian markets collectively increased by 7% year-on-year during the first five months of 2020. However, this growth may also mask supply-side adjustments. For instance, in Bangladesh, state-owned Petrobangla reported cuts to domestic production in April to offset an average 30% drop in consumption since the implementation of a nationwide lockdown.

Pakistan is one of the few emerging Asian markets where LNG imports declined over the first five months of 2020, falling by almost 14% year-on-year. There was a 50% drop in daily gas consumption as of early April compared to monthly operational forecast. Several factors contributed to this sharp decline, including plant closures which reduced industrial gas demand by 50% relative to the forecast, lower electricity demand and higher hydropower production which cut gas-fired power generation by half.

In China, demand for natural gas from the industrial sector decreased by 6.7% year-on-year in April. The rebound in industrial activity in March was hindered by lockdown in other parts of the world, which limited demand for exported goods. Nevertheless, demand was estimated to have improved by 1% in May.

In India, natural gas consumption decreased by 25% year-on-year in April, following a nationwide lockdown in March. However, gas-fired generation increased by 14%, as low-cost imported natural gas was used to meet peak demand. Progressively, gas consumption resumed in May as restrictions were lifted, allowing chemical plants, factories and downstream industries to restart.

China and India’s imports grew in May, supporting the modest month‑on‑month increase in global LNG trade as European flows remained stable.

Forecast in global gas demand in 2021 – 2025

The industrial sector is expected to be the main contributor to the growth of gas demand until 2025, accounting for 40% of gas demand globally. Gas as a transport fuel is expected to grow at an average rate of 2.6%, driven mainly by Asia with the growing use of LNG for trucks and river transport. This forecast assumes a tenfold increase in LNG as an international maritime fuel (for container ships), reaching over 10 bcm by 2025.

According to the IEA, LNG remains the main driver of international gas trade. In 2019, the global LNG trade grew by 12%, with supply increasing by a record amount of over 50 bcm. The wave of investment in liquefaction projects from 2018 – 2019, should continue to deliver additional export capacity in North America, Africa and Russia. However, there is a risk of prolonged overcapacity. Indeed, slower growth in gas demand post-2020 may result in liquefaction capacity outpacing incremental LNG import through 2025.

China, India and emerging Asian markets account for most of the growth in future LNG imports, while Europe should return to its pre-2019 levels.

China is the main contributor, with the industrial sector leading the way. China possesses energy-intensive heavy industries, especially chemicals, a growing profile of light industries and the imperative to mitigate urban air pollution by implementing fuel alternatives to coal.

Should China maintain policies encouraging the shift from coal to gas, the country could become the world’s largest LNG buyer, with imports of 128 billion cubic metres per year by 2025. For the time being, China’s future coal-to-gas switching policies remain uncertain. It is possible that the construction of new coal-fired power plants may be accelerated to help boost the economy after the coronavirus-induced crisis.

In India, the industrial sector is expected to be the main driver, accounting for 36% of gas demand between 2019 and 2025. The IEA forecasts an increase in demand of 28 bcm per year between 2019 and 2025, thanks to a combination of supportive government policies and improved LNG and pipeline infrastructure. Rebound in gas demand will greatly depend on the timely execution of planned infrastructure projects, further gas market reforms and the affordability of imported gas for India’s price-sensitive consumers.

Sources:

[1] IEA (2020), Gas 2020, IEA, Paris https://www.iea.org/reports/gas-2020

[2] IEA, Natural gas demand decline per region, 2019-2020, IEA, Paris. Link

[3] IEA, Global LNG trade, January to May, 2018-2020, IEA, Paris. Link