Reducing emissions from China’s refrigeration sector

According to a recent report by the Economist Intelligence Unit, China is responsible for about one third of global emissions from refrigeration. The report presents scenarios for greening the refrigeration sector in China.

Market data on China’s refrigeration sector

According to a recent report by the Economist Intelligence Unit, China is the world’s largest producer and exporter of refrigeration equipment (referred to as “cooling equipment” in the report) and 70% of the world’s air conditioners are manufactured in China. According to this report, China exported USD 26.6bn worth of refrigeration equipment in 2019, accounting for about 61% of foreign demand. The United States and Japan are the two largest markets for China, importing 13.9% and 12.1% of China’s refrigerating equipment respectively. Six of the next eight leading export destinations are developing economies.

China is also the world’s leading user of household refrigeration equipment, accounting for 22% of installed household air conditioning units and 18% of the world’s household refrigerators.

Direct and indirect emissions from refrigeration in China

According to the report, China was responsible for 1355 Mt of CO2eq in 2019, representing about one third of global refrigeration emissions.

Direct emissions from refrigeration stem from the use of refrigerants, which can leak into the atmosphere at any point in the equipment life cycle: manufacturing, installation, operation and disposal. In China, total direct emissions from refrigeration reached 568 Mt of CO2eq in 2019, accounting for 42% of global emissions. The industrial and commercial sectors are major contributors to direct emissions, as the equipment used in these sectors is larger than household or mobile equipment.

Indirect emissions result from electricity generation and accounted for 787 MtCO2, i.e. 58% of CO2eq emissions in 2019. The refrigeration sector consumed about 1400 TWh of electricity in 2019, which represents 20% of the total electricity consumed in China. Commercial and industrial refrigeration equipment is more energy intensive than residential or mobile refrigeration equipment, as it tends to consume more electricity and operate for longer periods of time.

Forecast scenarios for the reduction of emissions from refrigeration in China

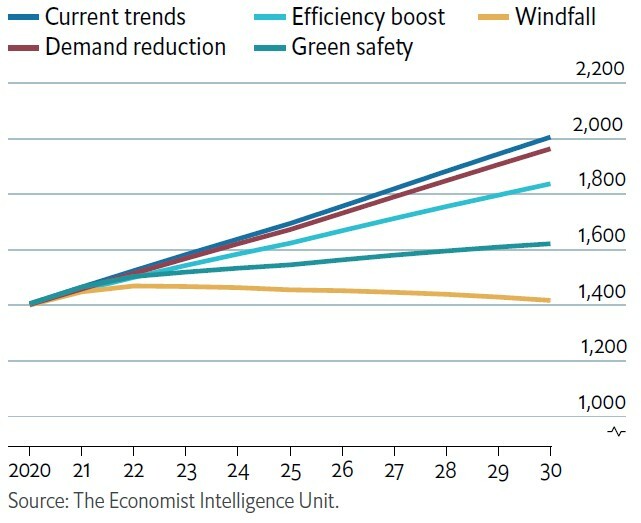

As rapid urbanisation and economic development continues, the Economist Intelligence Unit (EIU) expects that emissions from refrigeration could grow to 2,005 Mt by 2030, representing a 48% increase over 2019 levels. Therefore, the EIU developed a scenario-based forecast to explore the impact of the main policy levers available to the Chinese government on future greenhouse gas emissions by 2030. The “Current Trends” scenario is the reference, where pre-2020 trends are extrapolated through to 2030.

The four alternative scenarios are as follows:

- Demand Reduction. Consumer awareness campaigns help reduce the use of refrigeration equipment in the residential, commercial, industrial and mobile sectors until 2030. In this scenario, annual emissions in 2030 would be 2% lower than in Current Trends.

-

Efficiency Boost. Energy efficiency standards go beyond the targets outlined in China’s national “cooling plan”, resulting to greater adoption of high-efficiency equipment. In this scenario, energy efficiency is expected to be 47% to 60% higher in 2030 than in 2019. Annual emissions in 2030 would be 8% lower than in Current Trends.

-

Green Safety. This scenario demonstrates the potential of a complete transition to low-GWP refrigerants, assuming that safety issues are addressed through standards and training. Given refrigerants’ large contribution to emissions, a transition to low-GWP refrigerants would have a significant impact. This scenario is based on an average GWP decrease of 47% in 2030 compared to 2019. It could in particular reduce annual emissions from China’s domestic refrigeration sector by up to 266 Mt in CO2eq by 2030, relative to the Current Trends scenario. In this scenario, annual emissions in 2030 would be 19% lower than in Current Trends.

-

Windfall is the most optimistic scenario. It considers the combined impact of the demand-side utilisation shifts modelled in the Demand Reduction scenario, the efficiency gains modelled in the Efficiency Boost scenario and the refrigerant transition modelled in the Green Safety scenario. In this scenario, annual emissions in 2030 would be 29% lower than in Current Trends.

Economic benefits of emission reduction scenarios on China’s refrigeration sector

Greening China’s refrigeration sector is quite a challenge. Indeed, decades of rapid development mean that consumer awareness of environmental objectives remains low. Nevertheless, the aforementioned strategies could have substantial economic benefits for China. Consumer awareness campaigns in the Demand Reduction scenario could yield savings of USD 40bn over ten years. The energy efficiency standards of the Efficiency Boost scenario could free up USD 141bn in energy savings. The combined impact of demand reduction and energy efficiency savings, represented in the Windfall scenario, is USD 177bn. Concerning exports, higher energy efficiency and refrigerant standards could help expand China’s share of the global refrigeration equipment market by 4-5 percentage points. This could result in USD 1.4bn worth of new exports per year, representing 87,000 new jobs in refrigeration-related supply chains.

For further detail, please download the complete report on The Economist Intelligence Unit website or on FRIDOC. https://iifiir.org/en/fridoc/china-s-cooling-imperative-143661

Source

The Economist Intelligence Unit. China’s cooling imperative. https://eiuperspectives.economist.com/sustainability/chinas-cooling-imperative