Global LNG supply: the potential of Africa, South and Central America

IGU provides an update on the LNG supply outlook for countries in Africa, Central and South America.

In the October 2022 issue of its magazine "Global Voice of Gas", the International Gas Union (IGU) demonstrates that Africa, Central and South America can step up in providing the gas supply that the world needs.

African LNG

According to IGU, African LNG volumes could be boosted significantly with an increased use of existing LNG facilities, along with new FLNGs (floating liquefied natural gas facilities) under development and others in the pipeline. However, larger scale onshore, greenfield projects are unlikely to start operating before 2030.

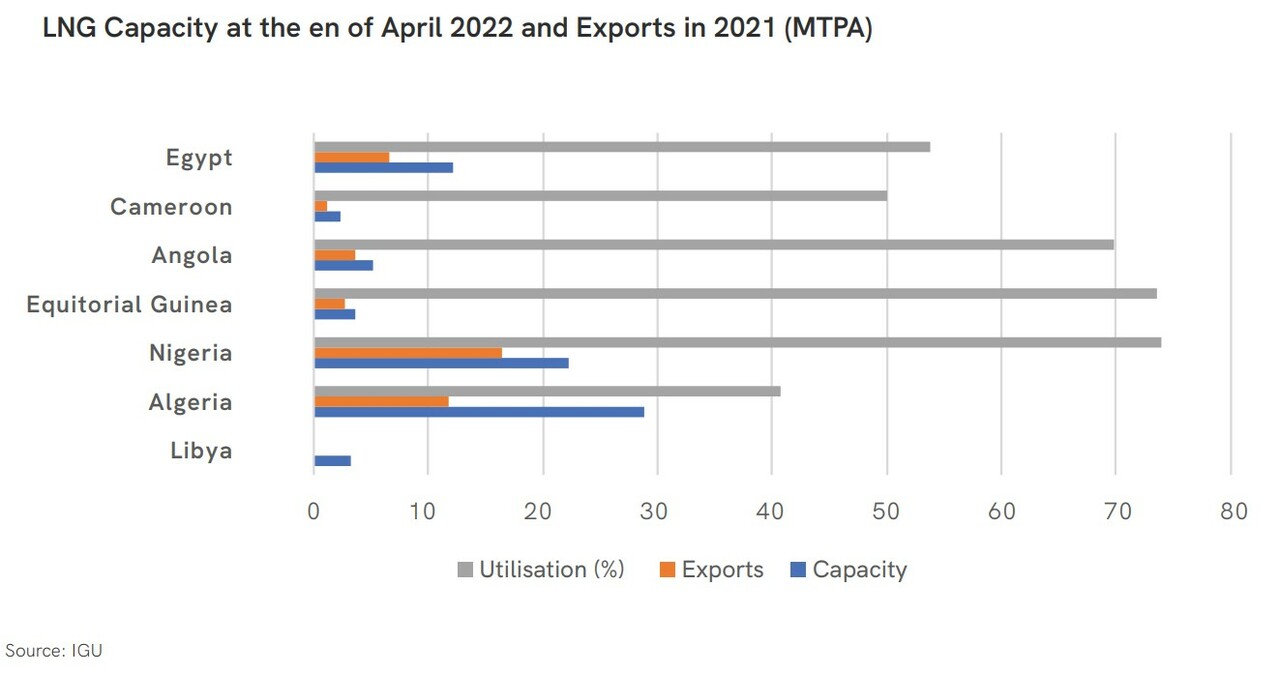

Among existing producers, LNG supply capacity is often underutilised. Africa has a total liquefaction capacity of 77.8 million tonnes per annum (MTPA), but its utilisation rate across all producers was only 54.4% in 2021. For instance, Algeria exported 11.78 MT of LNG in 2021, which represents about 40% of the country’s liquefaction capacity, according to IGU data.

The prospects for new LNG from Sub-Saharan Africa vary considerably in terms of timing and scale. Plans for two large onshore LNG facilities in Mozambique continue to be frustrated by the security situation in the north of the country. In West Africa, incremental gains are expected from Africa’s only producing FLNG vessel off Cameroon. So far, the facility has been operating at 50% of its 2.4 MTPA capacity, but this is expected to rise as development drilling increases gas supply. In Nigeria, the LNG Train 7 is about 30% complete. T7 will have a capacity of 8 MTPA and would bring NLNG’s total capacity to 30.8 MTPA. In the light of construction and engineering delays, 2025 should be a realistic start-up date.

South and Central American prospects

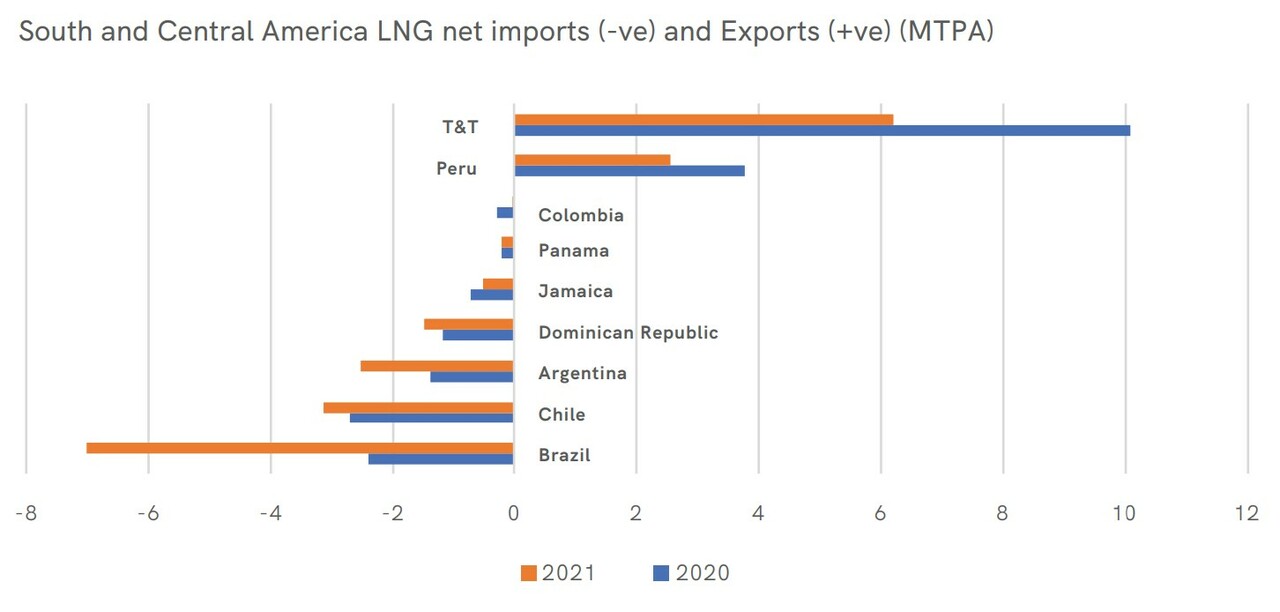

High levels of political risk and the recurring financial crisis continue to hamper gas development in Central and South America. For instance, Peru is the only country in South America to export LNG. It started in 2010 with the single-train, 4.45 MTPA Peru LNG. Currently, for Peru to increase its LNG capacity, numerous competing interests need to be tied together amid an unstable political environment.

Trinidad and Tobago is Central America’s only LNG producer from the four-train Atlantic LNG complex. In 2021, liquefaction capacity was reduced from 14.8 to 11.8 MTPA due to a lack of feedstock gas, which resulted in the shutdown of one of the four liquefaction trains at the complex. LNG exports amounted to only 6.19 MT in 2021, down from 10.08 MT in 2020, according to IGU data. However, the start-up in April 2022 of the Shell operated Colibri field has boosted gas output, and other upstream projects are underway. With spare liquefaction capacity in place, the accelerated development of Trinidad and Tobago’s offshore resources should enable the country's LNG exports to recover in the near term.

According to IGU, Argentina may hold the best potential for large-scale LNG exports in South and Central America, but when and if remain open questions. Building liquefaction capacity would be a step further; this was accomplished on a small scale in 2019 via a floating liquefaction vessel.

Source

IGU. Global Voice of Gas #3 Vol 2. https://www.igu.org/news/global-voice-of-gas-3-vol-2/